They constitute a standardised way of describing the companys financial performance and position so that company financial statements are understandable and comparable across international. A sustainability report is the one where a company or an organization discloses its social environmental and governance performance.

Example Of Income Financial Statements Report Download Scientific Diagram

A Report on the Similarities and Differences between IASC Standards and US.

. International Financial Reporting Standards commonly called IFRS are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board IASB. Parent company financial statements should generally be presented in the same report with the reporting entitys consolidated financial statements eg SEC filings. Attachment - STE Report Form.

Many private companies are breathing a collective sigh of relief since the FASB postponed the effective date for the new lease accounting standard ASC 842 now Q1 2021 for calendar year-end private companies. ASC 810-10-45-11 provides the authoritative basis for parent company financial statements under US GAAP. Financial Reporting 1 of 14 Issued on.

29 April 2022 PART A OVERVIEW 1 Introduction 11 The Malaysian Financial Reporting Standards MFRS which serve as a basis for financial reporting in Malaysia have been fully converged with the International Financial Reporting Standards IFRS from 1 January 2012. Financial Reporting FR Youll develop knowledge and skills in understanding and applying accounting standards and the theoretical framework in the preparation of financial statements of entities including groups and how to analyse and interpret those financial statements. Top three implementation mistakes to avoid.

A sustainability report is the one where a company or an organization discloses its social environmental and governance performance. FINANCIAL ACCOUNTING AND REPORTING. Attachment - FAQ on STE.

GAAP copyrighted by the Financial Accounting Standards Board Norwalk Connecticut USA 1999Please note. Deferred tax is a topic that is consistently tested in Paper F7 Financial Reporting and is often tested in further detail in Paper P2 Corporate Reporting. Just for the matter of clarity sustainability reporting can be considered synonymous with other.

Penyediaan Penyata Kewangan mengikut Piawaian Malaysian Financial Reporting Standards MFRS Implementation Guidance on Agreed-Upon Procedures AUP and the preparation of the Report of Factual Findings. 18 December 2019 Lease accounting lessons from 200 public companies. This document is an excerpt from the FASBs The IASC-US.

The Common Reporting Standard CRS is an information standard for the Automatic Exchange Of Information AEOI regarding financial accounts on a global level between tax authorities which the Organisation for Economic Co-operation and Development OECD developed in 2014. International Financial Reporting Standards Understanding Fundamentals I FRS I FRS Technically reviewed by Ian Hague Principal Accounting Standards Board AcSB Canada. This article will start by considering aspects of deferred tax that are relevant to Paper F7 before moving on to the more complicated situations that may be tested in Paper P2.

Its purpose is to combat tax evasionThe idea was based on the US Foreign Account Tax. APPENDIX D SUMMARY OF THE FASBS IASC US GAAP.

Solution Manual For Advanced Financial Accounting An Ifrs Standards Approach 3rd Edition Solution Manual For Advanced Financial Financial Accounting Solutions

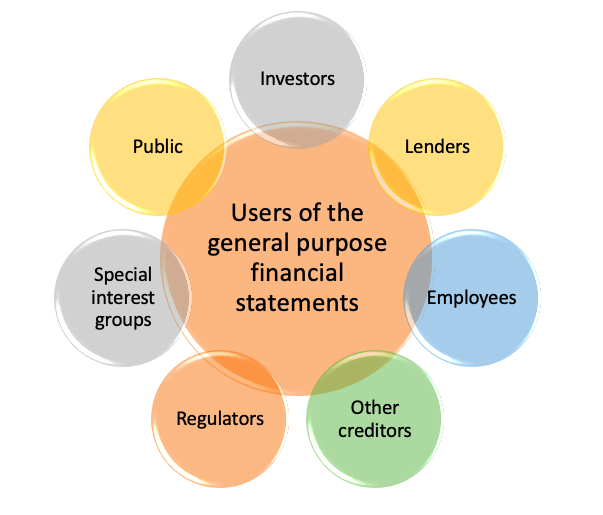

Accounting 101 Objectives And Users Of The General Purpose Financial Statements Theaccsense

Theory Of International Financial Reporting Standards Ifrs Implementation Emerald Insight

0 Comments